Vouchsafe partners with Equifax, Moneyline to take on financial inclusion

Vouchsafe has joined forces with Equifax, a leading credit reference agency, and Moneyline, a lender for the financially underserved, to build next-gen KYC (Know Your Customer) technology.

Together, we are participating in FinTech Scotland’s Consumer Duty Innovation Challenge, alongside other partners including NatWest, Barclays, and Lloyds Banking Group.

The challenge will culminate in a demo day in Glasgow in January.

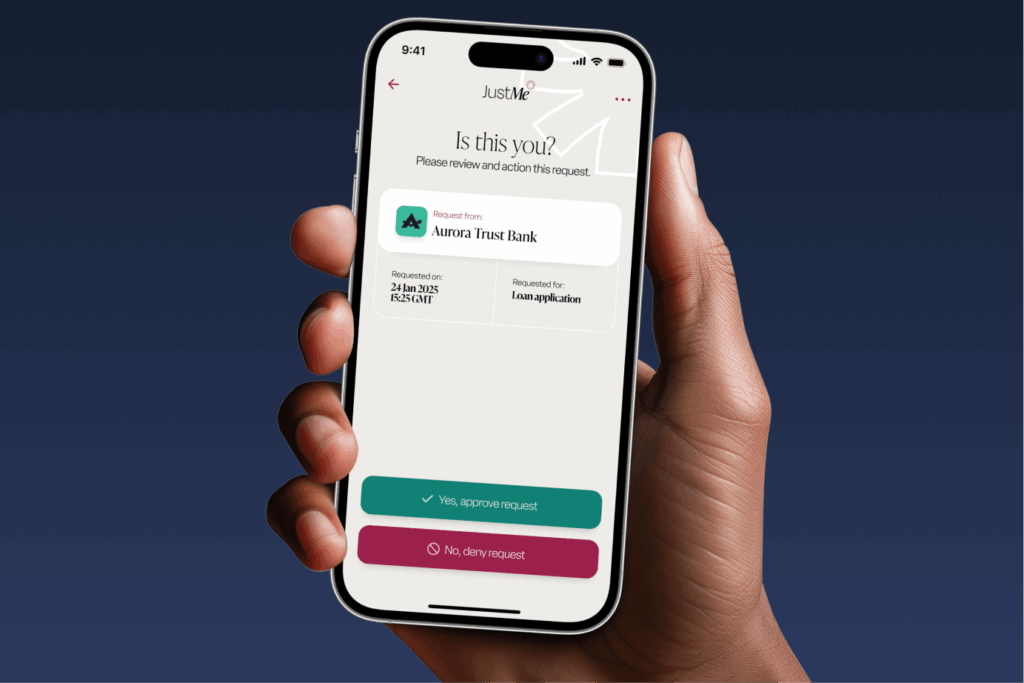

Vouchsafe’s unique technology fully automates KYC decisions, making financial services more accessible to underserved populations without relying on costly, manual verification.

In the UK, over 11 million people lack adequate photo ID, and 20 million are financially underserved.

Traditional KYC methods fail these people, with a typical failure rate of 20-40%, often requiring in-person or paper-based checks. Incredibly, two-thirds of firms still carry out most of their KYC processes manually, at substantial cost.

The cost of living crisis is making the problem worse as more consumers rely on options like buy-now-pay-later services that do not report to the mainstream credit bureaus. Fewer people are driving or renewing passports, further squeezing access to photo ID.

Chloe Coleman, CEO, Vouchsafe, said:

“Vouchsafe was built to solve real barriers to financial access, not just for today’s underserved communities but for those impacted by emerging challenges. The Consumer Duty Challenge is an ideal launchpad to reimagine financial inclusion.”

Rachel Magowan, CTO, Moneyline, said:

“It’s great we get to work with Vouchsafe on our challenge, automation shouldn’t mean more people excluded. We just need to get better at how we automate and develop Tech for Good.”

Robert McKechnie, Head of Product, Equifax said:

“As a data-led business, we see consumer duty as an opportunity to leverage insights in real time, driving smarter, more personalised solutions which will help to enable good consumer outcomes. This innovation challenge allows us to explore fintech solutions that not only support regulatory requirements but also improve customer experience.”

About Vouchsafe

Vouchsafe is a tech-for-good company tackling ID poverty. It provides flexible, inclusive KYC technology and supports the widest range of verification evidence, including using trusted referees to fill evidence gaps.

Using explainable AI, Vouchsafe reduces manual processes to make safe, reliable decisions that do not exclude people.

Vouchsafe serves the 1 billion worldwide who lack access to ID, as identified by the World Bank.

Vouchsafe’s first major customer is the Scottish Government, and they are backed by Bethnal Green Ventures and Big Issue Invest.

About the founders

Chloe Coleman led user research at Universal Credit and brought basic bank accounts to claimants experiencing homelessness.

Jaye Hackett led the early research, design and prototyping of what became the NHS coronavirus contact tracing app in the early days of the pandemic.

To learn more about the partnership, contact chloe at chloe@vouchsafe.id.